Federal balance to be balanced in 2025 – but relief package 27 still necessary

Berne, 18.02.2026 — The Confederation ended 2025 with a financing surplus of CHF 0.3 billion. The improvement relative to the budget is primarily attributable to a temporary increase in receipts from the canton of Geneva. The Federal Council was informed of this provisional result during its meeting on 18 February 2026. At the same time, it launched work on the next budget. Despite the balanced financial result, the federal finances remain tight: structural deficits can still be expected for 2027 to 2029, even with relief package 27 and the planned VAT increase for the Armed Forces and security. Without these measures, the deficits from 2027 onwards would amount to between CHF 2 and 4 billion.

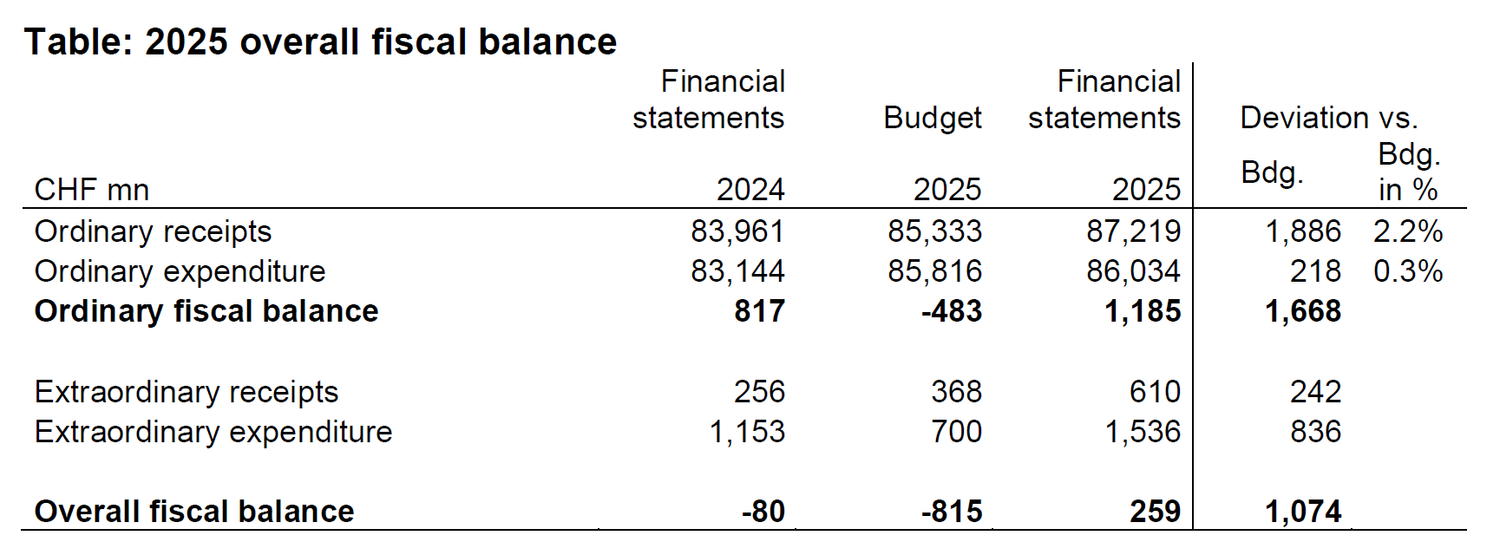

The Confederation posted a financing surplus of CHF 0.3 billion in 2025, primarily due to a temporary increase in profit tax receipts from the canton of Geneva (1.5 bn). A deficit of CHF 0.8 billion had been budgeted. Overall, ordinary receipts were CHF 1.9 billion, or 2.2%, higher than budgeted (long-term average deviation: 0.3%). At the same time, federal ordinary expenditure in 2025 was above the budgeted figure for the first time since the debt brake was introduced in 2003. This is due, among other things, to the supplementary credit for Horizon Europe (EU research).

The increased receipts from the additional distribution by the Swiss National Bank (333 mn) were booked to the extraordinary budget. There was no profit distribution in 2023 and 2024. The additional expenditure resulted from the capital contribution to SBB (850 mn). This partly offset SBB's COVID-related losses.

Financial outlook

Despite the balanced financial result, the federal financial outlook for 2027 to 2029 remains challenging. Owing to the strong growth in expenditure, the federal budget will continue to show a structural imbalance for the next few years. The level of the deficits will largely depend on two key proposals: relief package 27, which the National Council, the second chamber, is due to debate in the spring session; and the VAT increase to finance the Armed Forces and security, for which the DDPS will prepare a consultation draft.

Following the cuts of around CHF 900 million to relief package 27 decided by the first chamber, the Council of States, the 2027 budget is currently no longer balanced. After updating receipts and expenditure, and taking into account the Council of States' reduced version of relief package 27, the current outlook is for a structural deficit of around CHF 400 million.

The VAT increase of 0.8 percentage points to finance the Armed Forces and security as foreseen in the financial plan in addition to relief package 27 will result in a temporary balancing of the federal budget – in 2028 at least. However, 2029 will once again see a structural deficit of CHF 0.8 billion. This is primarily due to the fact that expenditure for the Armed Forces (outside the funds proposed by the Federal Council) and the federal contribution to AHV are growing significantly faster than receipts. Without the planned VAT increase, a deficit of around CHF 0.7 billion could be expected for financial plan year 2028, and a CHF 1.8 billion deficit for 2029.

The tight budget situation is also forcing the Federal Administration to prioritise consistently. At the end of January 2026, the Federal Council conducted a comprehensive review of resource requirements and distribution within the Federal Administration from 2027 onwards. This revealed that digitalisation in particular requires a high level of funding: on the one hand, significant investment is needed, and on the other hand, operating costs are also rising. Due to the necessary prioritisation, it is becoming apparent that the federal government will not be able to push ahead with various digitalisation projects at the desired pace.

Next steps

After the spring session, the Federal Council will have to decide on further measures to comply with the debt brake in the 2027 budget, taking into account Parliament's decisions on relief package 27. Due to the short time frame, it will only be able to target loosely earmarked expenditure.